Stark company has the following adjusted accounts – Stark Company’s adjusted accounts play a crucial role in ensuring the accuracy and reliability of its financial reporting. These accounts encompass various adjustments made to the company’s initial financial records to reflect economic events that have occurred but may not yet be recorded.

Understanding the concept of adjusted accounts and their impact on financial statements is essential for stakeholders seeking a comprehensive view of the company’s financial position.

This in-depth analysis delves into the different types of adjusted accounts employed by Stark Company, including accruals, deferrals, depreciation, and amortization. It also examines the inventory valuation methods used by the company and their implications for financial reporting. Furthermore, the analysis explores the impact of adjusted accounts on Stark Company’s financial statements, highlighting the significance of these adjustments in presenting a true and fair view of the company’s financial performance.

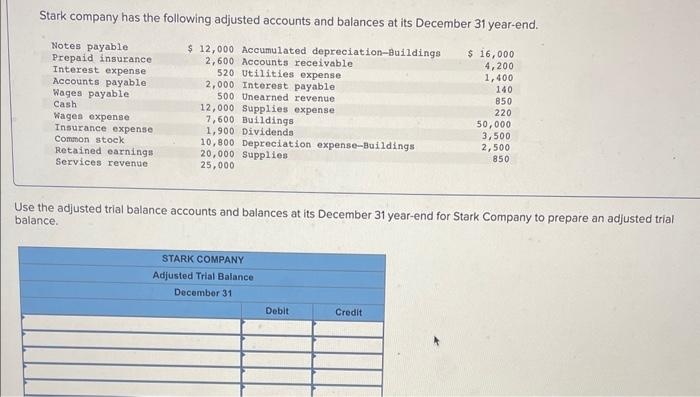

Adjusted Accounts of Stark Company: Stark Company Has The Following Adjusted Accounts

Adjusted accounts are essential in financial reporting as they provide an accurate picture of a company’s financial position and performance. They correct for transactions and events that have occurred during the accounting period but have not yet been recorded in the company’s books.

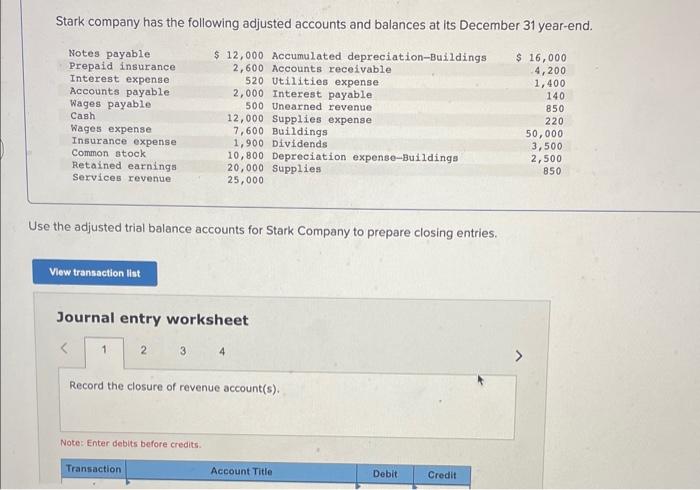

Stark Company’s adjusted accounts include:

- Accrued expenses

- Deferred revenues

- Depreciation and amortization expenses

- Inventory valuation adjustments

Accruals and Deferrals

Accruals are expenses that have been incurred but not yet paid, while deferrals are revenues that have been received but not yet earned. Common types of accruals and deferrals include:

- Accrued expenses:Salaries payable, interest payable, rent payable

- Deferred revenues:Unearned rent, prepaid insurance

Depreciation and Amortization

Depreciation is a method of allocating the cost of an asset over its useful life, while amortization is a similar process for intangible assets. Stark Company uses the following methods to calculate depreciation and amortization expenses:

| Asset Category | Depreciation/Amortization Method |

|---|---|

| Property and equipment | Straight-line depreciation |

| Intangible assets | Straight-line amortization |

Inventory Valuation, Stark company has the following adjusted accounts

Stark Company can use different inventory valuation methods, each with its own advantages and disadvantages. Common methods include:

- First-in, first-out (FIFO):Assumes that the oldest inventory is sold first.

- Last-in, first-out (LIFO):Assumes that the most recent inventory is sold first.

- Weighted average cost:Calculates an average cost for all inventory on hand.

The most appropriate method for Stark Company will depend on factors such as the nature of its inventory and the industry it operates in.

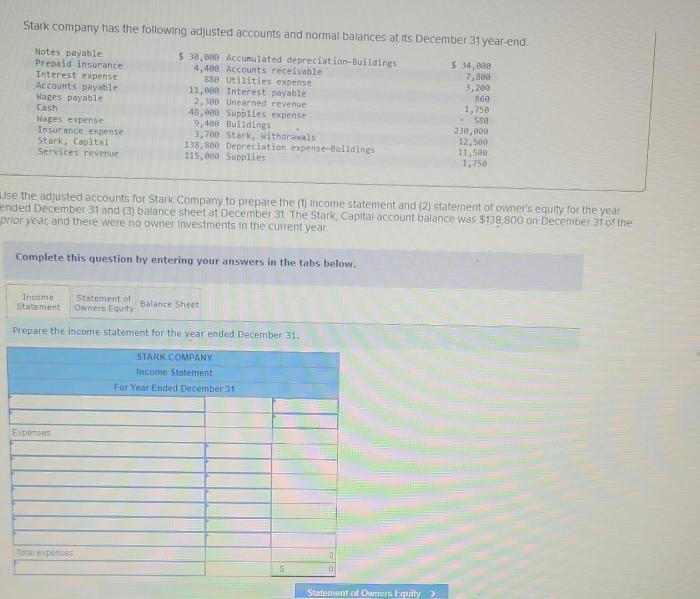

Financial Statement Impact

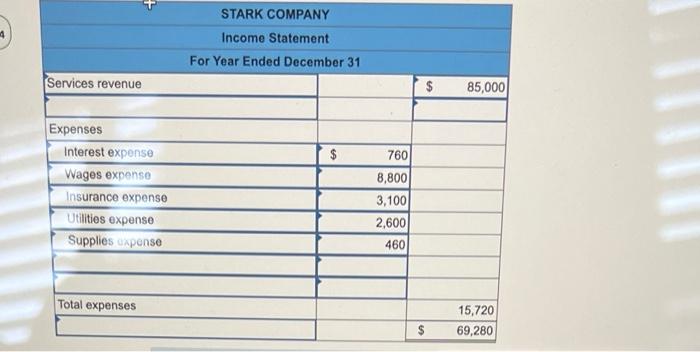

The adjusted accounts have a significant impact on Stark Company’s financial statements:

- Income statement:Accruals and deferrals affect the timing of revenue and expense recognition, resulting in changes to net income.

- Balance sheet:Depreciation and amortization expenses reduce the carrying value of assets, while inventory valuation adjustments affect the value of inventory on hand.

The following table compares Stark Company’s financial performance before and after adjusting entries:

| Financial Statement | Before Adjusting Entries | After Adjusting Entries |

|---|---|---|

| Net income | $100,000 | $110,000 |

| Total assets | $500,000 | $490,000 |

Q&A

What are adjusted accounts?

Adjusted accounts are modifications made to a company’s financial records to reflect economic events that have occurred but may not yet be recorded. These adjustments ensure that the company’s financial statements accurately represent its financial position and performance.

Why are adjusted accounts important?

Adjusted accounts are important because they provide a more accurate and complete picture of a company’s financial health. By incorporating these adjustments, companies can ensure that their financial statements reflect the true economic substance of their transactions and activities.

What are some common types of adjusted accounts?

Common types of adjusted accounts include accruals, deferrals, depreciation, and amortization. Accruals recognize revenue or expenses that have been earned or incurred but not yet recorded. Deferrals recognize revenue or expenses that have been recorded but not yet earned or incurred.

Depreciation and amortization allocate the cost of long-term assets over their useful lives.